AI use cases in finance: Benefits and real-time examples

How is AI shifting the landscape of the finance industry? Some interesting use cases of AI in this industry and how pathbreaking companies have employed it. Jump right on to bid goodbye to mundane, error-prone, and time-consuming processes in this fast-evolving industry.

Jagadeesan

Dec 12, 2025 |

6 mins

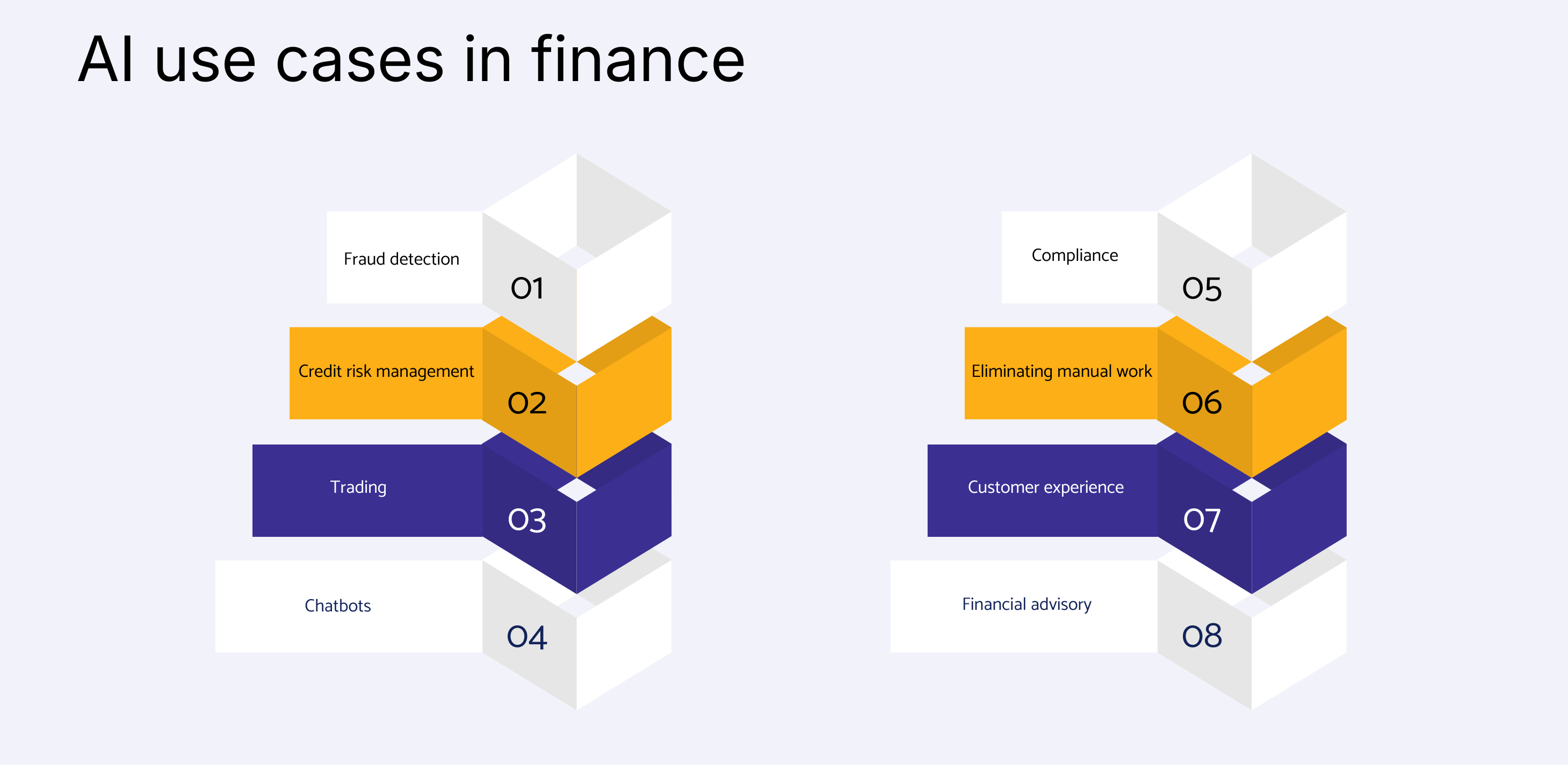

Top 8 use cases of AI in financial services

AI in finance is changing the way customers interact with financial institutions, thanks to chatbots. However, there are more AI use cases and applications for the financial industry, like fraud detection, robo advisors, credit risk models, stock price predictors, etc.

Some benefits of AI use cases for the financial industry include fast processes and increased operational efficiency, reduced errors, automated compliance checks, portfolio optimizations, enhanced customer experience, and faster onboarding.

Here is a list of the 8 best use cases for ai in financial services below.

1. Fraud detection

The flipside of tech growth is the evolution of fraudulent activities. Banks and financial services require robust solutions to combat these modern cyber crimes, spoofing, fake accounts or records, etc.

But AI can detect and prevent it all from this never-ending list of heinous activities.

Why AI for fraud detection?

AI-based systems can identify and prevent these fraud instances and change the finance industry from being reactive to proactive.

AI applications in such cases can analyze multiple instances at once. It can be used to study the pattern of an account holder and understand their payment behaviors. This can identify and flag suspicious activities precisely when they befall. The system will fine-tune itself after a few instances which in turn improves accuracy.

While speaking about automatic fraud detection, we also have to consider false positive cases which may affect the customer experience of genuine users. Also, fraudsters constantly evolve and modify their methods to mimic closely the real customers.

Some AI algorithms are capable of flagging fraudulent activities accurately without interrupting a real customer by raising a false alarm.

Real-time example

Mastercard in partnership with 9 other banks is utilizing AI to prevent organized money scams. They employed an intelligent system that analyzes many data points—sender, receiver, the amount being sent, history of transactions between them, is this the first time they transact a huge amount, etc., and nib fraud in its bud before it happens.

Whether it’s a bank or a financial institution, 96% of customers prioritize safety among their selection factors. So, adopting a fraud detection solution early is the right way to go for scaling organizations.

Learn more AI in logistics

2. Credit risk management

Assessing the creditworthiness of an applicant is a manual process—from collecting recordings to passing human judgment. With diverse applications, products, and customers, the risk assessment can take longer time than usual, and be prone to human errors. AI in risk management makes this process swifter even for larger datasets with multiple variables and offers more reliable results.

Why AI for credit risk management?

The number of factors impacting credit risks is increasing. Banks and credit unions consider base factors and overlays like market conditions, cyber risk, digital footprints, etc. AI can compute all these and even more, if required for multiple applications simultaneously, reducing hours of processing.

These ML-based credit scoring models can generate accurate insights based on the data fed and even suggest other possible business opportunities.

Who has done it already?

Equifax, a credit bureau company is using a model combination of AI and neural networks to generate an explainable credit score. Their customers find it useful too, as they see reasons behind the score and get actionable insights to work on.

3. Trading

AI trading is making waves as it helps traders make use of opportunities 24/7. To do this in the traditional sense, they have to spend hours understanding markets or struggle with delayed insights. Results? Not so favorable decisions. That’s where AI trading comes in.

Why AI for trading?

Within trading, AI finds its place in multiple tasks—building a portfolio, optimizing it, making predictions, finding stocks to invest in, etc. For instance, stock pickers can help select the stocks to buy or sell based on the criteria set by investors and their risk tolerance levels.

Understanding market sentiment is also important for traders and investors. With the help of sentiment analysis, they can receive insights from multiple sources like social media, news, and forums in real time and apply them while trading.

Other than providing insights and finding patterns, AI can also help in performing high-frequency trading—which a human cannot do. It is processing multiple orders simultaneously as market pricing changes every second.

4. Chatbots

In sectors like finance, instant assistance matters which is where chatbots are proven efficient. Customers agree with this too—63% of customers don’t mind receiving help from a chatbot when customer personnel aren’t available.

This is how an AI use case in finance, chatbots, improves customer experience.

Why AI for customer service?

Other than consistent availability, financial AI chatbots have other benefits too. They get the nuances of human interactions and mimic them to the closest level. They can be trained on various topics to assist. From guiding customers to auto-onboard to offering financial advice, they can do it all.

Plus, there is no limit on the number of chat requests they can handle.

Real-time example

ICICI has launched iPal to help customers with the application process, buy financial products, or receive general assistance. Similarly, HSBC has Amy, and Citi Bank has Citi Bot, all built in with basic and advanced capabilities.

5. Compliance

Finance services are required to adhere to multiple compliance requirements. From keeping up with changing regulatory norms to preventing breaches and security incidents, and minimizing process errors. With AI, they can streamline and get this under control.

Why AI for compliance needs?

AI-based risk assessment tools are effective in due diligence and the know-your-customer process, alerting the compliance team to focus on the security incident and tightening the security protocol further. This protects financial institutions from getting exploited out of harmful activities like money laundering.

Likewise, the list of compliance requirements to follow often changes. To ensure stringent adherence, one can employ AI-driven legal research tools that update them on current regulations, policies, and frameworks.

Other than this, AI is also effective in optimizing underwriting processes and preventing ML and other financial fraud.

6. Eliminating manual work

McKinsey suggests that 30% of activities in 60% of professions can be fully automated, which includes finance, also with many manual tasks that demand meticulous attention.

How does AI help with automating business processes?

AI can automate many processes in finance - from major tasks like loan approvals, credit scoring, and portfolio management, to simple back-office functions. Benefits? It frees up time wasted on monotonous tasks, gets it done with improved efficiency and precision, and makes room for creative and strategic operations.

Some of the tasks businesses already automate with AI are accounts payable and receivable, client segmentation, smart data entry and analysis, report generation, run predictions, customer support, etc. Surprisingly, even statistics point out automation as one of the most used AI use cases in financial services.

Some most important finance sector tasks that AI can automate are:

Loan approvals - This is the process of scrutinizing a loan application and deciding whether the applicant is eligible for a loan or not. This considers multiple factors like the applicant’s age, salary, gender, marital status, credit score, current debts, security, etc, which might vary for each loan product. We can train the machine learning model with the above datasets to approve or reject a loan application and improve its efficiency through continuous monitoring and feedback.

Credit scoring - Mathematical credit scoring models often look at historical data like previous loans to determine credit eligibility. So, offering credit to a new customer becomes a hitch. AI-based credit scoring models can overcome this as they can take into account myriad factors like the applicant’s employment or earning scope and other factors the financial institution wants to consider, so they can maximize profits by covering nuanced areas without risks.

Customer segmentation - This is grouping different clients based on different criteria—relevant to your goals. For example, customers of the same demographic region, gender, or age group can be segmented, or based on feedback given (positive, negative, or neutral), or based on financial behavior or engagement. The list can go on and on.

Why segmentation? It offers endless possibilities—running user-specific marketing campaigns, optimizing digital product interfaces depending on usage, tailored product or feature recommendations, and more.

7. Customer experience

Other than chatbots, AI enhances customer experience in other ways too.

Why AI for customer experience?

One effective use case of AI and deep learning in financial services is sentiment analysis. The evolution of natural language processing has opened doors for in-depth exploratory analysis. This can scan through customers’ feedback, social media posts, comments, and other reviews and share insights on what they think.

Another way is predictive analytics which can offer insights into your customer preferences and needs. So, you can be ahead in serving what they want, which means higher satisfaction and reduced churn. These insights can also help personalize the experience for different customers and target them with relevant new products.

Learn more: AI use cases in Manufacturing

Real-time example

Capital One finance company has launched a voice assistant called Eno. It not only acts like a customer service agent. It can share smart spending insights, make auto-security checks with customers for previously made payments, and bring to notice curated offers.

8. Financial advisory

Robo-advisors have been around a lot and customers use it to automate their investment transactions. This does what human asset managers do but in a more automated fashion.

Robo advisors are becoming the future of AI in the finance industry, helping a wider audience, being available 24/7, and personalizing experiences to suit different users and their portfolios.

Why AI for financial advisory?

Machine learning algorithms can learn and adopt the market language better and analyze multiple factors before offering suggestions. These suggestions can be predictions about future stock values, why to buy or sell stocks, how to diversify, considering risk tolerance, investment caps, and other pre-defined preferences. This is better compared to a human advisor who has to spend time collecting market insights and doesn’t always have historical records in hand. It automates most of the tasks so all a customer should do is invest the money.

AI-based financial advisory is needed beyond trading as well. From real estate to other asset management, AI can be incorporated.

Real-time example

Investment companies like Wealthfront have already employed robo advisors for personal financing and investing.

Learn more: Decision making in artificial intelligence

Final thoughts

The finance industry has seen enormous evolution and the next stop is Artificial intelligence. It’s predicted that AI investment will reduce operational costs by 22% for financial services, which can amount to $1 trillion. Top players are already in the race, implementing the most effective use cases and finding success with a highly satisfactory ROI.

Given the pervasive nature of this technology, we can already see others join this race too.

Challenges arise when you have to find the most suitable use case, start building your AI strategy, or when you have to know if your data can support it. There are many types and variants of AI used in the finance industry, like machine learning, NLP, computer vision, deep learning, robotic process automation, genAI, and reinforcement learning. You will need the right team beside you with experience building similar applications to help you navigate through these technologies and find the suitable solution.

Take finance to the next level with intelligent predictions—explore our predictive analytics solutions.

by Jagadeesan

“datakulture’s co-founder, thought leader, and skilled team leader, Jagadeesan has worked with companies across industries and geographies. He knows how data problems hide in plain sight—whether in manufacturing floors, retail shelves, or financial dashboards—and how the right strategy can turn them into opportunities. With years of experience guiding teams and clients alike, he ensures data solutions don’t just look good on paper but deliver measurable business impact.