Solving churn with cohort analysis

Churn is a biggest problem for many industries, let alone SaaS and eCommerce models. Our BI team worked with one such company, bringing visibility into customer health and revealing churn patterns through cohort analysis. Our BI expert shares what worked for the team and how to build scalable churn analysis solutions.

Jagadeesan

Oct 28, 2025 |

16 mins

Cohort analysis: what is it and who it is for

“You run campaigns but aren’t sure if those customers stick around or just buy once.”

“You notice sales spikes during discounts but don’t know if those buyers come back.”

“You wonder if new users from last month still active today are.”

That’s exactly what cohort analysis solves.

Cohort analysis is a concept of grouping customers into categories called cohorts and comparing their behavior over time. For example, a company just groups every customer who subscribed to the product during Black Friday and Spring sales and compares their behavior for the whole year.

Cohort analysis is effective for teams like marketing, UX, eCommerce, product, and finance teams. Here’s how each team can use this analysis to drive better outcomes.

Teams | How it benefits them |

|---|---|

Marketing | Measure campaign effectiveness by visualizing dropping and retained customers over weeks/months. |

eCommerce | Understand repeat vs. One-time purchases or study customer behavior of those who purchase during discounts vs. full price. |

Product and UX teams | Spot what drives customers away or gets them upgrade to something bigger. |

Finance and strategy | Estimate Customer Lifetime Value (CLV) by seeing how long different cohorts keep spending. |

Time-based vs behavioural cohort analysis

Aspect | Time-based cohort | Behavioral cohort |

|---|---|---|

Definition | Groups customers by when they first signed up, purchased, or started using the product. | Groups customers by what they do inside the product (e.g., features used, campaigns responded to). |

Focus | When customers joined. | How customers behave. |

Example in SaaS | Users who signed up in January vs. February. | Users who completed onboarding vs. those who skipped it. |

Example in eCommerce | Shoppers who made their first purchase during Black Friday week vs. Christmas week. | Shoppers who bought via discount codes vs. full-price buyers. |

What it reveals | Retention, churn, or revenue patterns across different signup/purchase dates. | Which behaviors drive loyalty, revenue, or churn. |

Questions it answers | “Do users who try Feature A retain longer than those who don’t?” | “Do users who try Feature A retain longer than those who don’t?” |

Best For | Seasonal analysis, campaign performance, growth trend tracking. | Product optimization, marketing personalization, customer success interventions. |

Tooling Tip | Easier to build in BI (Power BI/Tableau) with signup/purchase dates. | Needs event-level data from analytics tools (Amplitude, Mixpanel) but can also be modeled in BI. |

Cohort analysis – step by step guide

Getting started with cohort analysis is easy if you know how to do it right. In just 5 steps, we have explained how to do cohort analysis for any use case with two examples, one, a SaaS product with a freemium funnel and another one, an eCommerce business selling mid-ticket items.

1) Define the goal

Anyone can do cohort analysis. But what many complain about it is that in the end all they get are “pretty heatmaps with little impact”. How to maximize outcome then?

1 - The first decision is what event defines entry into the cohort. Examples of cohort analysis use cases include the following:

SaaS: Signup, first login, or feature activation?

eCommerce: First purchase or first subscription start?

Content apps: First stream or first 3 sessions?

2 - Start with one sharp question per audience and make it falsifiable.

For a SaaS leader, a good goal might be: “Do users acquired via paid search in January reach a 30-day activation rate of at least 45%, and do they retain at 25% by day 90?”

Similarly, for an eCommerce scenario, a crisp goal is: “Do first-purchase cohorts acquired during a 20% sitewide discount repeat within 60 days and deliver positive contribution margin after returns?”

3 - These goals are actionable because they set expectations (targets), fix time horizons (30/60/90 days), and tie to money (activation or margin).

4 - Decide the right time window & granularity. Goals differ if you look at retention daily, weekly, or monthly.

If you can’t phrase your goal with a time box and a success threshold, keep sharpening it; otherwise, your cohort work will drift into descriptive analytics that’s interesting but doesn’t change spend, product priorities, or go-to-market tactics.

2) Identify the tools (instrument the journey, not just the checkout)

To get real value, you need tools that capture the whole customer journey, not just a single snapshot like “who converted.” Here’s how to think about it:

1 - Track user behavior

For cohort analysis, experts use tools like Google Analytics 4, Mixpanel, Amplitude, or Clevertap.

These tell you what users click, where they drop off, and how often they return.

2 - Connect to your source of truth

Set up your data warehouse (BigQuery, Snowflake, Redshift, Postgres) holds the final word on revenue, orders, invoices, and refunds.

This is the data finance and operations trust most.

3 - Bring in marketing context

CRMs and CDPs (like HubSpot, Salesforce, Segment) add campaign and channel data.

They explain where customers came from and why.

4 - Tell the story visually

BI tools like Power BI or Tableau make cohorts easy to read for stakeholders.

They turn raw numbers into heatmaps, curves, and dashboards everyone can align on.

Here is why these matters:

Many companies do this mistake while plotting cohort analytics. They either use product analytics, which misses finance and ops data. Or, they only use finance data, missing customer journeys. By centralizing all of it in one place, you avoid the inconsistency issue, where two different teams may see two different data. Example: “my dashboard says 37%, yours says 41%” debate.

3) Measure the right metrics

A cohort analysis is only as useful as the metrics you choose to track. Don’t overwhelm yourself with numbers, choosing more than 20—focus on the few that reveal how customers behave over time.

1 - Pick the starting point (the “anchor event”)

SaaS → When someone signs up or activates a feature.

eCommerce → When someone makes their first purchase.

2 - Choose your key metrics for cohort churn analysis.

Retention rate → How many customers stick around over time.

Repeat purchase rate → How often customers buy again.

Revenue retention → How much money you’re keeping from each group.

Churn → How many customers leave, and when.

Time-to-value → How fast customers see results or benefits.

3 - Compare across time

Group customers based on the comparison periods and timelines. Example: January vs February.

Then track how each group performs in later months.

Why this matters: This is where it gets all descriptive. You’re no longer just asking “How many sales did we make?” — instead, you’re asking “Which groups of customers are truly valuable, and why?”

4) Visualize & Analyze the Patterns

This is where your work comes alive. The same numbers in a spreadsheet are hard to explain — but in Power BI or Tableau, they tell a story.

1 - Use heatmaps

Rows = the month a group of customers joined.

Columns = the months after that.

Colors = retention, repeat purchases, or revenue.

Darker color = stronger performance.

2 - Add supporting visuals

Line charts → Show how retention drops or stabilizes over time.

Bar charts → Compare cohort sizes (so you don’t overreact to tiny groups).

Filters → Let leaders drill into specific products, regions, or campaigns.

3 - Example from Power BI (based on what we have already built)

A SaaS leader sees that customers acquired via paid ads have a steep drop-off in Month 1, while organic cohorts flatten higher.

That instantly sparks a marketing decision: shift spend from ads to channels that bring stickier users.

Why this matters: Visualizing cohorts helps leaders see patterns at a glance, so they can act quickly without digging into rows of data.

Points to consider while building cohort analysis using Power BI

Decide once what your “starting point” is (signup, first purchase, activation). Don’t keep changing definitions across reports — it will cause confusion (“Why does my dashboard say 37% but yours says 41%?”).

Handle incomplete periods carefully. The most recent cohorts don’t have enough time to mature. In Power BI, blank out or gray out those cells so leaders don’t misinterpret them.

Do the math in SQL or your data warehouse, then bring clean tables into Power BI, so that heavy calculations (like period differences, retention %) can slow Power BI.

Retention rates are useful, but leaders want to see revenue too. Add ‘Revenue retention %’ or ‘Contribution margin by cohort’ alongside user counts.

You can include slicers or drill-downs to compare product categories, customer types, or acquisition types.

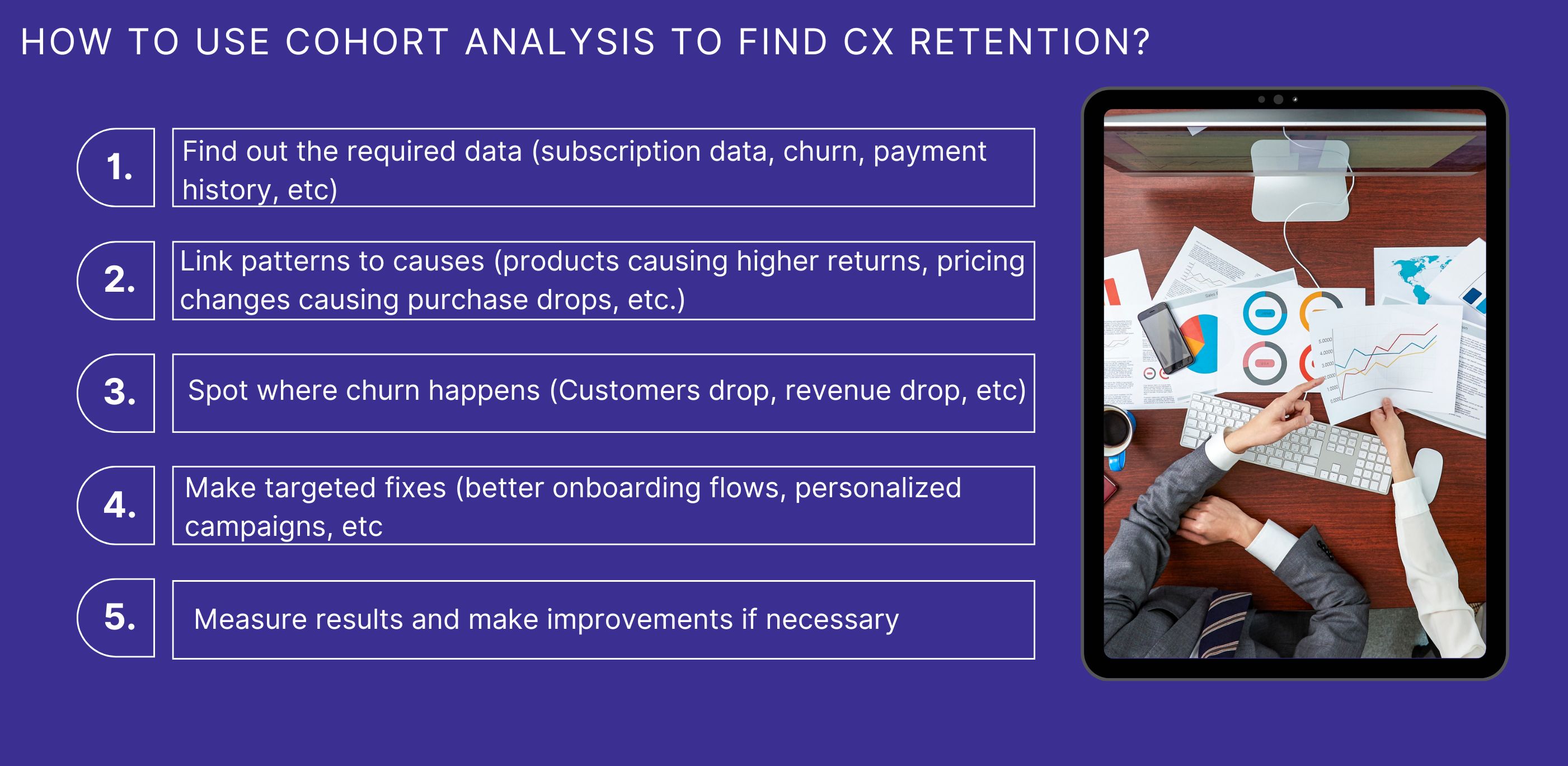

Finding retention and churn cohort analysis

The ultimate point of cohort analysis isn’t to make a fancy chart — it’s to spot problems and act on them. Cohort analysis tells you not just that churn exists, but where and why it happens, that’s how you know what action to take to fix it.

1 - Spot where churn happens

SaaS → Customers drop after Month 1 → Fix onboarding or activation.

eCommerce → Customers don’t return after their first purchase → Rethink discounts, loyalty programs, or follow-up offers.

2 - Link patterns to causes

Are certain products causing higher returns?

Do customers from one campaign churn faster than others?

Are renewals dropping because pricing changed?

3 - Make targeted fixes

Improve onboarding flows.

Test personalized campaigns.

Adjust capacity or inventory for high-churn products.

What data is required for churn?

1 - SaaS (Subscriptions,digital products, B2B/B2C apps)

To measure churn, you need data that shows who the customer is, their subscription state, and their activity:

Customer identifiers → User ID, Account ID, Email (to track cohorts consistently).

Subscription details → Start date, renewal date, plan type, billing cycle, contract length.

Status flags → Active, Cancelled, Paused, Trial, Expired.

Payment history → Invoices, successful/failed payments, refunds.

Product usage/engagement → Logins, feature adoption, last activity date (to detect “silent churn” where users stop using before cancelling).

Support/CSAT data (optional) → Ticket history, NPS scores (can explain why churn happens).

2 - eCommerce (Retail, marketplaces, D2C)

Churn in eCommerce is about customers not coming back to buy again. For that, you need:

Customer identifiers → User ID, Email, Loyalty ID (to tie purchases across sessions).

Order history → Order ID, date, items, quantities, revenue, returns/refunds.

Time between purchases → Calculated from order dates to spot lapsed customers.

Product categories → Which types of products were bought (to see if churn is category-specific).

Channel/source → Acquisition source (ads, organic, email) to see which channels bring sticky vs churn-prone buyers.

Discount/promotions used → To check if discount-driven cohorts churn faster.

Engagement signals (optional) → Cart abandonment, email clicks, app visits, wishlists.

Metrics that matter (and why)

You will need different metrics for cohort analysis metrics for both SaaS and eCommerce.

Metrics | Why it’s required? |

|---|---|

Activation Rate (D7/D14) | The earliest predictor of long-tail retention; moving this 5–10 points often yield step-function gains down the curve. |

M1/M3 Retention % | The macro health view; select thresholds by plan tier or ICP to avoid mixing apples and oranges. |

Net revenue retention (NRR) by cohort | Captures expansion/downgrade dynamics; great for PLG where upsell trails activation by 30–90 days. |

Time-to-Value | Median days from signup to key outcome; aim to compress this and your entire heatmap usually brightens |

Support Touches per New User | Quality guardrail; if this rises while retention rises, you may be papering over UX debt. |

For eCommerce:

Metrics | Why it’s required? |

|---|---|

Repeat purchase rate (30/60/90) | Shows whether acquisition is sticky; compare promo vs. non-promo cohorts to set discount policy. |

Time-to-second-purchase | A growth lever; bringing this forward by even a week can materially lift CLV. |

Contribution margin per cohort | Revenue minus COGS, shipping, and returns; retention without margin is just busywork. |

Returns rate & reasons | Flag cohorts with high post-purchase friction; target education, sizing, or packaging fixes by category. |

Email/SMS opt-in & engagement by cohort | Determines whether lifecycle marketing can economically drive the next purchase. |

Final thoughts

Cohort analysis is no longer just a tool for analysts — it’s becoming crucial across industries and teams. Marketing leaders use it to track campaign ROI and customer loyalty. Product teams rely on it to see which features actually drive retention. Customer success teams use it to spot churn risks early. Even in manufacturing, retail, and healthcare, leaders are applying cohorts to understand demand cycles, patient journeys, and repeat purchase patterns. With the right design in platforms like Power BI or Tableau, we help organizations build cohorts that go beyond numbers — turning them into clear, actionable stories that align teams and guide smarter decisions.

by Jagadeesan

“datakulture’s co-founder, thought leader, and skilled team leader, Jagadeesan has worked with companies across industries and geographies. He knows how data problems hide in plain sight—whether in manufacturing floors, retail shelves, or financial dashboards—and how the right strategy can turn them into opportunities. With years of experience guiding teams and clients alike, he ensures data solutions don’t just look good on paper but deliver measurable business impact.