How to identify high value customers with RFM analysis?

Our data analysts share how to use RFM analysis to identify high value customers based on recency, relevance, and monetary value. If your goal is to devise best engagement strategies for every customer group, this is a must read.

Gowtham

July 22, 2025 |

9 mins

During one of my recent travels, I stumbled upon a small gelato shop. The owner knew exactly who walked in, and when.

The lady with the toddler on her brisk 9 AM walk.

The boy with the blue cycle, always in by 5 PM.

The retired uncle who’d drop by every other Saturday for a quiet scoop of hazelnut.

No CRM. No customer segmentation. But we’re not all Joyce’s choco chip ice creams. We’ve got 1000s of customers, complex journeys, and the memory of a goldfish.

And that’s exactly why RFM analysis exists.

It helps you do what Joyce did—at scale.

RFM analysis is mandatory for any business who needs the following.

Understand who buys often.

Who hasn't visited in a while.

And who splurged big, but only once.

So, whether you're running a CX study, a loyalty program, or a retention campaign, RFM turns behavior into insight.

And lets you treat every customer like they’re your favorite regular.

So, what’s RFM analysis?

RFM analysis is a data exploration strategy that lets you divide customers based on the following factors:

Recency: When did the customer last buy?

Frequency: How often do they buy?

Monetary: How much have they spent?

Every customer is scored from one to five on all the above criteria. When a customer scores 5 on all the above criteria, then they actively buy from you, buy often, and spending big – those who fall under the high value customers category.

Once scored, you can also group customers and create micro-personas like loyalists, spenders, recurring customers, and so on, depending on the score range.

These are the ones driving the most revenue and most likely to respond positively to loyalty programs, early access offers, or personalized CX efforts. Hence, identifying them is critical for high marketing and sales conversions.

A sample RFM customer analysis table with recency, frequency, and monetary score.

Customer ID | Recency (days since last purchase) | Frequency (purchases) | Monetary ($) | Recency | Frequency | Monetary | RFM Score |

|---|---|---|---|---|---|---|---|

CUST_0001 | 103 | 44 | 3990 | 4 | 4 | 5 | 445 |

CUST_0002 | 349 | 30 | 746 | 1 | 3 | 1 | 131 |

CUST_0003 | 271 | 38 | 2988 | 2 | 4 | 5 | 245 |

CUST_0004 | 107 | 2 | 2535 | 4 | 1 | 4 | 414 |

Importance of using RFM analysis for customer segmentation

You might say that you predict demand in advance. But techniques like time series models in quantitative forecasting help predict what will happen and when—for example, how demand for a product changes week by week or how customer purchases peak during holidays. These models are great for predicting future behavior based on historical trends. But knowing demand patterns is only half the story.

RFM analysis is more of a behavioral fingerprint, something that generates predictive insights without complex models. Here is how it elevates your customer segmentation results.

Deliver personalized experiences at scale

Just like the gelato vendor throwing in offer to his everyday customers, you can deliver custom offers and experiences to a growing customer base.

Dynamic homepages and offers, synced with real-time inventory and user requirements.

Tailored email newsletters, messages, and push notifications

Other homepage and in-app experiences to suit customer categories, mainly pushing them to buy more.

For example, a customer who spends a lot, but not frequently, can be engaged through premium upgrades, triggers or concierge support.

Prioritizing high value customers

High value customers yield higher ROIs, if engaged right. That's what luxury brands do, shying away from blanket programs and run completely focused, tiered engagement strategies. Exactly what you should do too.

Exclusive offers, product demos, and in-person services for VIP customers

Winning back campaigns to bring back lost customers

Frequent nudges to one-time spenders.

Bridging conversions and customer ratings/reviews

Typically, the customer segmentation and behavioral data are siloed in many companies. This is where RFM helps. It helps analysts the following ways:

Mapping customer scores, ratings, and reviews to existing RFM segments (regular buyers, high spenders, rare users, etc).

This completes the loop allowing you to understand customers fully, showing you who is the happiest, who is most frustrated, and who is at risk.

You could connect what they said to their purchase patterns, which brings a whole new dimension to the customer experience.

Here’s an example that explains all the three cases discussed here.

A customer high in frequency and monetary value hasn’t spent recently. The integration of feedback layer has revealed that the customer is upset about delayed deliveries. The team chooses the re-engagement strategy – an express checkout option along with product offer may win the customer back.

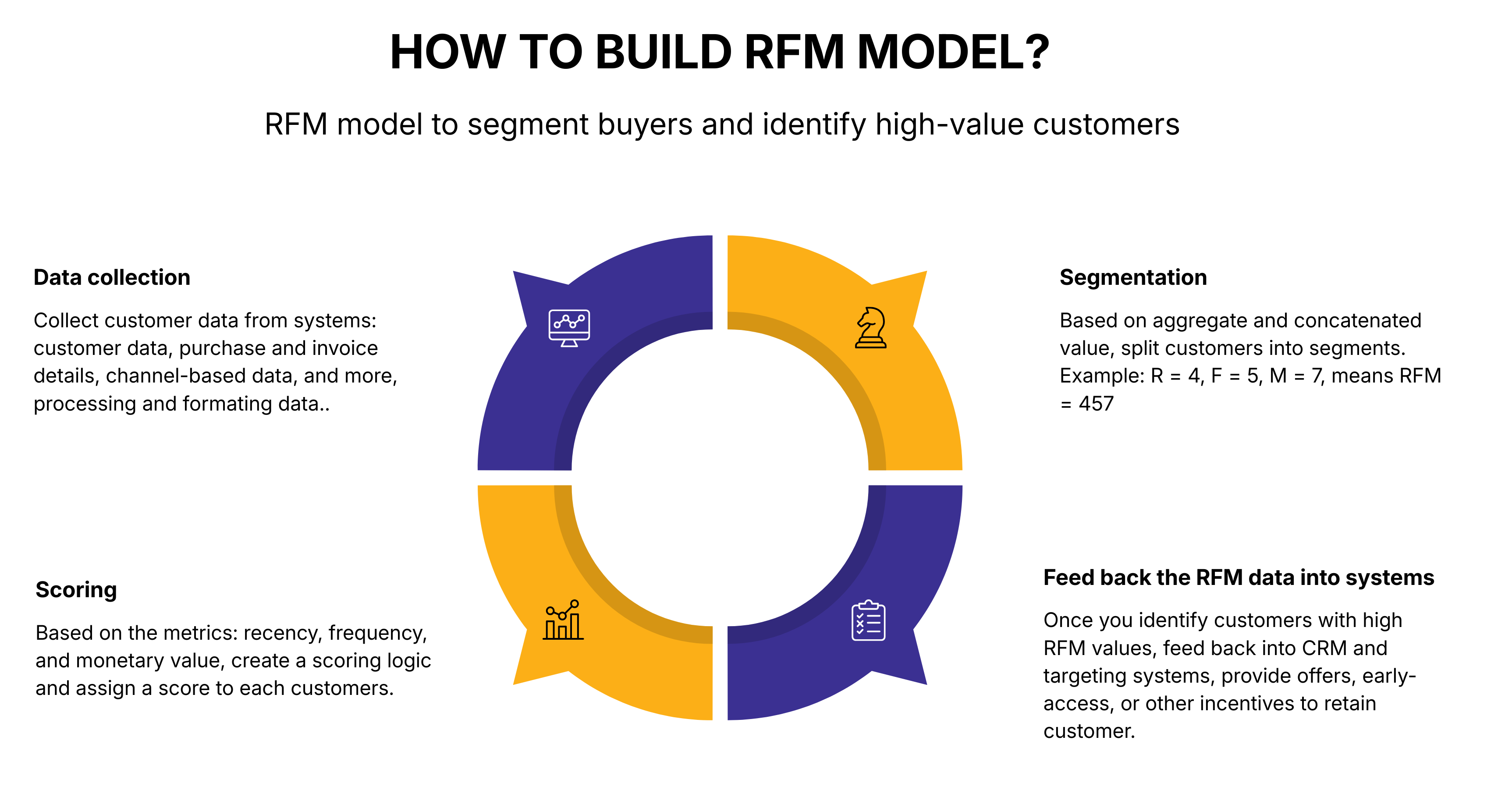

Build your RFM model to find your high value customers

So you have defined the goal – to find high value customers from your customer segments. Here's how you can do that by building an RFM analysis model with simple data exploration tools.

Gather data

First of all, you need data: customer data, purchase and invoice details, channel-based data, and more. Some of these source systems could be POS, CRM, payment gateways, order management systems, and more.

Employ ETL pipelines and pull the data via API calls or connectors for data ingestion and integration.

Time to clean and process the data as it makes its way to the storage system or database. You have to de-duplicate, format data fields, normalize customer IDs, and focus on other pre-processing needs, while building incremental pipelines to do this consistently.

Assigning the RFM score

The first step is to aggregate customer-level RFM metrics, writing logic for each metric: recency, frequency, and monetary value. While writing logic, please be mindful of your sales analysis period you want to consider along with the sales cycle length.

Here comes the scoring part. Your scoring logic is based on this, where you will be scoring based on the below logic from 1 to 5.

RFM Component | Scoring Logic |

|---|---|

Recency | Lower days = higher score (recent) |

Frequency | More orders = higher score |

Monetary | More spend = higher score |

There are three common ways through which you can assign scoring in RFM models.

Quantile based scoring system: The most common scoring method where each metric is split into quantiles and assigned a score, which will be evenly distributed across customers. You can implement this with the help of Python, Excel, or any data analysis tool.

Custom thresholds: You will set custom values for every metric range. For example, 0 to 30 days is 5. 30 to 60 days is 4. and so on. This method works well for smaller datasets and data with irregularities.

Z-score: Here, the metrics are converted into z scores, one of a common statistical method. Z-score is preferred typically for skewed and non-linear datasets.

Build segments and interpret

The above methods only assign scores to the metric. You will have to concatenate them, find its weighted score, or aggregate each score to identify the RFM value. Example for concatenating: R = 4, F = 5, M = 7. RFM = 457.

Once you have RFM values for the entire data set, you can create segments and seperate customer data based on segments.

Some of the common segments one can create along with the RFM value range are:

Customer group | Concatenated RFM Value |

|---|---|

High value customers | 555 |

Loyal customers | 543 |

At risk customers | 243 |

Lost customers | 100 |

You can use heatmaps, plots, or visualization tools to visualize high-value customer segments.

Add business context to it, connecting metrics like campaign performance, customer metrics like NPS, CSAT, etc.

Now you have filtered out high-value customer data, ready to be made actionable.

Set up tools to feed the collected RFM data

You can use the RFM segments and feed them into CRM, email marketing tools, customer support, or ad platforms.

It doesn’t stop there. This step opens door to many possibilities; scheduling early access programs, win back offers, incentives, and more, depending on the chosen category. Marketing teams can directly receive this RFM insights to power their campaigns and get definite results, engagement, impressions, clicks, and buys.

Other things you need to ensure for consistent RFM insights generation:

Check RFM scheduler jobs and ensure it’s running smoothly.

Monitor your shift segments and the uplift created post campaigns.

Keep updating RFM scoring models with inputs like recurring revenue, returns, reviews, and more.

And, that’s how you perform RFM analysis to determine and engage with high value customers, no ML models, no complex tools, can be flexible for any type of business. Above all, there’s measurable impact created.

Can small businesses use RFM analysis effectively?

RFM analysis works brilliantly for small teams and businesses due to the following reasons.

It doesn’t require too much logic and works on top of data you already have.

You don’t need a large team of data scientists or analysts. Just Excel or SQL scripts are enough to do this.

Less efforts. More results. You can just filter high spenders, double down on them with more offers and nurturing, and get planned ROI from them. That's how RFM analysis helps marketing team perform specific marketing that offers good results.

The inputs from RFM analysis guides your CX support team well. A curated list of at-risk or high spending customers to engage with.

If you start with RFM analysis with small volumes of data, you can scale well as the data grows, with a balanced and steady customer segmentation foundation.

A good RFM score

The good RFM score varies based on the RFM scoring logic you have chosen. For example, if you have selected the concatenation method, then the good RFM score means anything with high recency (4 or 5) along with either high frequency or Monetary value(s). Example ranges: 554, 545, 455.

If you are using sum-up method, then RFM score of 13 to 15 is excellent and anything above 10 is a good score.

Here's what the RFM score along with its respective segments (for summed up method).

Total RFM Score | Customer Quality |

|---|---|

13–15 | Excellent / High value |

10–12 | Good / Loyal |

7–9 | Medium / Occasional buyers |

4–6 | Low value / At risk |

3 | Dormant / Lost |

Final thoughts

RFM analysis isn’t just a framework. It helps you focus on the right segments, personalize campaigns, and boost retention without increasing cost. But turning raw data into meaningful action needs more than just scoring. That’s where we come in.

From building clean data pipelines to setting up automated RFM workflows to smoothly incorporating predictive Analytics in marketing, we help you set this up from ground, with or without models. Whether you’re starting with spreadsheets or scaling with customer platforms, we bring the expertise to tailor RFM to your business, no matter what industry or background you’re in.

by Gowtham

Gowtham, our senior data analyst and Tableau specialist, knows how to tame messy data and turn it into interactive visualizations that don’t just look good, but stay reliable. A true data storyteller, he understands what every report should reflect and delivers insights that matter. Beyond analysis, Y also brings his creativity to marketing—contributing through writing, idea sharing, and video making.